This includes things like employee wages, rent, and interest payments on debt owed to banks. An accounts payable is essentially an extension of credit from the supplier to the manufacturer and allows the company to generate revenue from the supplies or inventory so that the supplier can be paid. This means that companies are able to pay their suppliers at a later date.

- Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets.

- If expenses are only “counted” when you pay the bills, this can skew the tracking of expenses and the accuracy of the financial statements.

- I have encountered companies that do not track accounts payable, insisting that they “pay bills as soon as we get them.” This is not always the case.

- For example, paying an invoice within a discount period that many vendors provide.

- The cause of the increase in accounts payable (and cash flows) is the increase in days payable outstanding, which increases from 110 days to 135 days under the same time span.

- Accounts payable is also referred to as the department that handles vendor invoices or bills and records the short-term debts in the general ledger (GL).

As a result, your total liabilities also increase with the same amount. Now, the accounts payable represent the short-term debt obligations of your business. Hence, they form a part of the current liabilities on your company’s balance sheet.

Income Statement Terms

Payment authorization Includes setting payment details such as payment date, amount and getting final approval from the person in charge to process the payment execution. It requires a number of both “soft” and “hard” skills to be truly successful. Many people, even those in other finance roles, are not aware of all the tasks involved in managing a smooth Accounts payable process. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. Let’s say that on the invoice they sent you, Paint World offers you a 2 percent discount for paying within 15 days. To take advantage of it, you end up paying them exactly one week later, on July 17, 2019.

Only accrual basis accounting recognizes accounts payable (in contrast to cash basis accounting). AP helps to provide a true picture of the health of company finances. This is important for the business when it comes to effective cash flow management.

Hence, while accounts payables are recognized as a current liability, accounts receivables are recorded in the current assets section of the balance sheet. Accounts Payable (AP) is generated when a company purchases goods or services from its suppliers on credit. Accounts payable is expected to be paid off within a year’s time or within one operating cycle (whichever is shorter).

- In households, accounts payable are ordinarily bills from the electric company, telephone company, cable television or satellite dish service, newspaper subscription, and other such regular services.

- Not surprisingly, keeping track of accounts payable can be a complex and onerous task.

- Accounts payable most commonly operates as a credit balance because it is money owed to suppliers.

- This publication is provided for general information purposes only and is not intended to cover every aspect of the topics with which it deals.

- These billed amounts, if paid on credit, are entered in the accounts payable module of a company’s accounting software, after which they appear in the accounts payable aging report until they are paid.

By contrast, imagine a business gets a $500 invoice for office supplies. When the AP department receives the invoice, it records a $500 credit in the accounts payable field and a $500 debit to office supply expense. As a result, if anyone looks at the balance in the accounts payable category, they will see the total amount the business owes all of its vendors and short-term lenders. The company then writes a check to pay the bill, so the accountant enters a $500 credit to the checking account and enters a debit for $500 in the accounts payable column. Accounts payable, on the other hand, is the total amount of short-term obligations or debt a company has to pay to its creditors for goods or services bought on credit.

Accounts Payable Terms

This involves the management and payment of all bills received by the company. The ending cash balance in March is the beginning cash balance in April. Review your company’s balance sheet and analyze each asset and liability account to determine the impact on cash https://adprun.net/ flow. Accordingly, accounts payable has a credit balance since it is your current liability. This means the accounts payable balance would increase if there is a credit entry. However, the accounts payable balance would decrease if there is a debit entry.

Track international accounts payable with Wise Business

These expenses may include lodging, client dinners, car rentals, gasoline, office supplies, and multimedia materials used for presentations. The most common include goodwill, future tax liabilities, future interest expenses, accounts receivable (like the revenue in our example above), and accounts payable. The cause of the increase in accounts payable (and cash flows) is the increase in days payable outstanding, which increases from 110 days to 135 days under the same time span. Once the preceding step has been completed, the invoice is recorded in the company’s accounting system, using the invoice date as the entry date. For example, if an invoice has a date of September 1 and should be paid in 30 days, then it is logged in as of September 1, so that the accounting system will pay it on September 30.

Why You Can Trust Finance Strategists

As a result, accrued expenses can sometimes be an estimated amount of what’s owed, which is adjusted later to the exact amount, once the invoice has been received. Also called accrued liabilities, these expenses are realized on a company’s balance sheet and are usually current liabilities. Accrued liabilities are adjusted and recognized on the balance sheet at the end of each accounting period. Any adjustments that are required are used to document goods and services that have been delivered but not yet billed. An accounts payable workflow within any given organization begins when a supplier or vendor submits a bill or invoice to the accounts payable department. Accounts payable will then route the invoice for approval and when approved, the invoice is processed for payment.

On the flip side, delays in receiving payments (recorded as accounts receivable) lower cash flow. Larger organizations, with dedicated finance teams, may have an accounts payable department. This AP department is responsible for processing and paying bills correctly and on time. https://www.wave-accounting.net/ When the invoice is received by the purchaser, it is matched to the packing slip and purchase order, and if all is in order, the invoice is paid. This is referred to as the three-way match.[3] The three-way match can slow down the payment process, so the method may be modified.

Why should I pay attention to my accounts payable?

Review your systems for managing accounts payable and use technology to automate the process. Use QuickBooks accounting software to scan invoices, post payables https://accountingcoaching.online/ into your accounting system, and pay invoices electronically. It could refer to an account on a company’s general ledger, a department, or a role.

Equity basically represents the shareholders’ equity or net worth of the company as assets with fewer liabilities equals net worth. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

未经允许不得转载:德讯证券顾问 » What is accounts payable? Clear definition and examples

德讯证券顾问

德讯证券顾问 周末重要消息汇总:中国版Sora来了,人形机器人“天工”发布

周末重要消息汇总:中国版Sora来了,人形机器人“天工”发布 热爆了,AI大牛股股价创历史新高,这些上市公司近期获超百家机构调研

热爆了,AI大牛股股价创历史新高,这些上市公司近期获超百家机构调研 中国首个Sora级视频大模型Vidu发布 生数科技与清华联合推出

中国首个Sora级视频大模型Vidu发布 生数科技与清华联合推出 从“看多”转向“做多” 北向资金单日扫货224亿元创出历史新高

从“看多”转向“做多” 北向资金单日扫货224亿元创出历史新高 “科技成长”主线被机构集体看好,业绩稳定增长且持续高ROE的科技股仅8只

“科技成长”主线被机构集体看好,业绩稳定增长且持续高ROE的科技股仅8只 周末重磅!人形机器人“天工”实现拟人奔跑!产业缺口巨大,超跌 高增长潜力股出炉

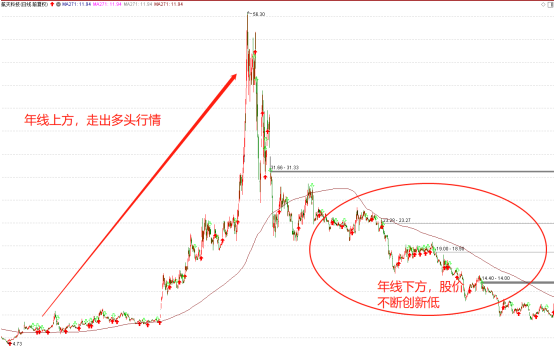

周末重磅!人形机器人“天工”实现拟人奔跑!产业缺口巨大,超跌 高增长潜力股出炉 【独家课堂】年线的运用技巧

【独家课堂】年线的运用技巧 【热点跟踪】市场风格大切换,科技股全面爆发

【热点跟踪】市场风格大切换,科技股全面爆发

评论前必须登录!

登陆 注册