A data room is a valuable instrument for demonstrating the worth of your company and its potential to investors. It is generally used for due diligence in M&A deals however, it can be beneficial in fundraising, IPOs, and other investor gatherings. Preparing a dataroom could be lengthy and at times overwhelming task. How do you determine what documents to include What should they be organized and grouped? How do you establish permissions for them?

As a startup, you need to be focusing on sharing data that will help you tell your story. It will differ by stage, for instance those in the early stages of their business may wish to provide information on market trends, regulatory shifts and compelling “why now” forces; while growth-stage http://virtualdataroomsoftware.net/ma-and-value-driver-analysis/ companies should concentrate on the latest trends in key metrics, new revenue, customer acquisition and the like.

Be cautious about providing too excessive information. In fact, too much information could cause investors to become overwhelmed and could signal that your team doesn’t know what’s important for the business. Also, ensure that the metrics you use are representative of all data instead of being selectively presented (like simply displaying “bright spots”).

Using an annotation tool allows users to add their own comments and questions to any document in the virtual data room. This keeps discussions on track and facilitates managing the Q&A process. To reduce the chance that sensitive information is shared with third party, it’s essential to have specific permissions on documents and folders. Look for a service provider that provides a variety of reporting tools to monitor user activity. For example what documents are being seen when.

未经允许不得转载:德讯证券顾问 » Data Room Analysis for Startups

德讯证券顾问

德讯证券顾问 周末重要消息汇总:中国版Sora来了,人形机器人“天工”发布

周末重要消息汇总:中国版Sora来了,人形机器人“天工”发布 热爆了,AI大牛股股价创历史新高,这些上市公司近期获超百家机构调研

热爆了,AI大牛股股价创历史新高,这些上市公司近期获超百家机构调研 中国首个Sora级视频大模型Vidu发布 生数科技与清华联合推出

中国首个Sora级视频大模型Vidu发布 生数科技与清华联合推出 从“看多”转向“做多” 北向资金单日扫货224亿元创出历史新高

从“看多”转向“做多” 北向资金单日扫货224亿元创出历史新高 “科技成长”主线被机构集体看好,业绩稳定增长且持续高ROE的科技股仅8只

“科技成长”主线被机构集体看好,业绩稳定增长且持续高ROE的科技股仅8只 周末重磅!人形机器人“天工”实现拟人奔跑!产业缺口巨大,超跌 高增长潜力股出炉

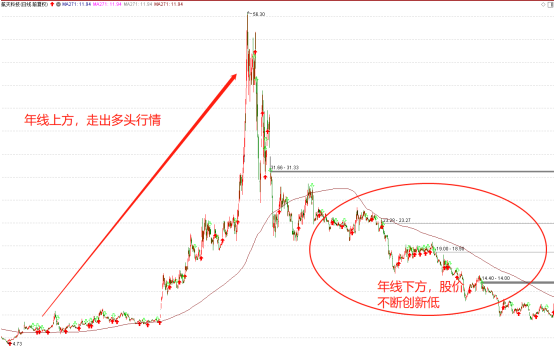

周末重磅!人形机器人“天工”实现拟人奔跑!产业缺口巨大,超跌 高增长潜力股出炉 【独家课堂】年线的运用技巧

【独家课堂】年线的运用技巧 【热点跟踪】市场风格大切换,科技股全面爆发

【热点跟踪】市场风格大切换,科技股全面爆发

评论前必须登录!

登陆 注册