Not only must an adjustment to Merchandise Inventory occur at the end of a period, but closure of temporary merchandising accounts to prepare them for the next period is required. Temporary accounts requiring closure are Sales, Sales Discounts, Sales Returns and Allowances, and Cost of Goods Sold. Sales will close with the temporary credit balance accounts to Income Summary.

You can consider this “recording as you go.” The recognition of each sale or purchase happens immediately upon sale or purchase. In a perpetual LIFO system, the entire opening cost is transferred to cost of goods sold on June 23. On November 18, the cost of seventy units bought on July 6 is also transferred. That leaves thirty units at $11 each ($330) plus the December 16 purchase of fifty units at $15 each or $750.

- There are more chances for shrinkage, damaged, or obsolete merchandise because inventory is not constantly monitored.

- The outcomes for gross margin, under each of these different cost assumptions, is summarized in Figure 10.21.

- He has a CPA license in the Philippines and a BS in Accountancy graduate at Silliman University.

- To determine the value of Cost of Goods Sold, the business will have to look at the beginning inventory balance, purchases, purchase returns and allowances, discounts, and the ending inventory balance.

- This is “Applying LIFO and Averaging to Determine Reported Inventory Balances”, section 9.5 from the book Business Accounting (v. 2.0).

Under Periodic LIFO, the inventory and COGS are updated at the end of the accounting period, not continuously. Cost of goods sold ($1,048) is higher than under FIFO ($930) so that the reported gross profit (and, hence, net income) is lower by $118 ($1,020 for FIFO versus $902 for LIFO). If inventory is central to your business, it must be managed, and to do that it, must be measured.

First-In First-Out (FIFO Method)

Under a periodic LIFO system, however, layers are only stripped away at the end of the period, so that only the very last layers are depleted.

One cost $110 while the other three were acquired for $120 each or $360 in total. Total cost was $470 ($110 + $360) for these four units for a new average of $117.50 ($470/4 units). The applicable average at the time of sale is transferred from inventory to cost of goods sold at points A ($110.00), B ($117.50), and C ($126.88) below. The perpetual system is generally more effective than the periodic inventory system. That’s because the computer software companies use makes it a hands-off process that requires little to no effort. Products are barcoded and point-of-sale technology tracks these products from shelf to sale.

Example of the Difference between Perpetual LIFO and Periodic LIFO

Assume that a company’s accounting year is January 1 through December 31 and the company sells only one type of product. In summary, the company had 2 units on January 1, purchased 5 units on April 1, sold 4 units during the year, and has 3 units on hand at December 31. The choice between perpetual and periodic inventory systems depends on the size, complexity, and nature of your small business. Even if you’re a small business, that doesn’t mean that the perpetual inventory system isn’t beneficial to you. In choosing an inventory system, you have to weigh the costs and benefits.

Perpetual vs. periodic: How to select the right method for your business

The $87.50 (the average cost at the time of the sale) is credited to Inventory and is debited to Cost of Goods Sold. The balance in the Inventory account will be $262.50 (3 books at an average cost of $87.50). The perpetual https://accounting-services.net/ inventory system keeps track of inventory balances continuously. This is done through computerized systems using point-of-sale (POS) and enterprise asset management technology that record inventory purchases and sales.

Periodic versus Perpetual Inventory Systems

The inventory at the end of the period should be $8,895, requiring an entry to increase merchandise inventory by $5,745. Cost of goods sold was calculated to be $7,260, which should be recorded as an expense. The credit entry to balance the adjustment is $13,005, which is the total amount that was recorded as purchases for the period. This means that the periodic average cost is calculated after the year is over—after all the purchases for the year have occurred. This average cost is then applied to the units sold during the year and to the units in inventory at the end of the year.

Learn How NetSuite Can Streamline Your Business

Although the first cost incurred in a period (the cost transferred to expense under FIFO) is the same regardless of the date of sale, this is not true for the last or most recent cost (expensed according to LIFO). Mayberry Home Improvement Store reports gross profit using periodic LIFO of $902 (revenue of $1,950 less https://quickbooks-payroll.org/ cost of goods sold of $1,048). One advantage of the periodic inventory system is that counting inventory allows you to identify shrinkage (inventory that is lost, stolen, or damaged). Inventory that is only managed on the cloud can more easily disappear and end up being sold out of the back of a truck somewhere.

Although periodic and perpetual FIFO always arrive at the same results, balances reported by periodic and perpetual LIFO frequently differ. The first cost incurred in a period (the cost transferred to expense under FIFO) is the same regardless of the date of sale. However, the identity of the last or most recent cost (expensed according to LIFO) depends on the perspective. Figure 10.12 shows the gross margin resulting from the weighted-average periodic cost allocations of $8283. Let’s return to the example of The Spy Who Loves You Corporation to demonstrate the four cost allocation methods, assuming inventory is updated at the end of the period using the periodic system. On December 31, 2016, a physical count of inventory was made and 120 units of material were found in the store room.

Once those units were sold, there remained 30 more units of beginning inventory. At the time of the second sale of 180 units, the FIFO assumption directs the company to cost out the last 30 units of the beginning inventory, plus 150 of the units that had been purchased for $27. Thus, after two sales, there remained 75 units of inventory that had cost the company $27 each. Ending inventory was made up of 75 units at $27 each, and 210 units at $33 each, for a total https://intuit-payroll.org/ FIFO perpetual ending inventory value of $8,955. As you’ve learned, the periodic inventory system is updated at the end of the period to adjust inventory numbers to match the physical count and provide accurate merchandise inventory values for the balance sheet. The adjustment ensures that only the inventory costs that remain on hand are recorded, and the remainder of the goods available for sale are expensed on the income statement as cost of goods sold.

未经允许不得转载:德讯证券顾问 » Using Different Inventory Valuation Methods CFA Level 1

德讯证券顾问

德讯证券顾问 周末重要消息汇总:中国版Sora来了,人形机器人“天工”发布

周末重要消息汇总:中国版Sora来了,人形机器人“天工”发布 热爆了,AI大牛股股价创历史新高,这些上市公司近期获超百家机构调研

热爆了,AI大牛股股价创历史新高,这些上市公司近期获超百家机构调研 中国首个Sora级视频大模型Vidu发布 生数科技与清华联合推出

中国首个Sora级视频大模型Vidu发布 生数科技与清华联合推出 从“看多”转向“做多” 北向资金单日扫货224亿元创出历史新高

从“看多”转向“做多” 北向资金单日扫货224亿元创出历史新高 “科技成长”主线被机构集体看好,业绩稳定增长且持续高ROE的科技股仅8只

“科技成长”主线被机构集体看好,业绩稳定增长且持续高ROE的科技股仅8只 周末重磅!人形机器人“天工”实现拟人奔跑!产业缺口巨大,超跌 高增长潜力股出炉

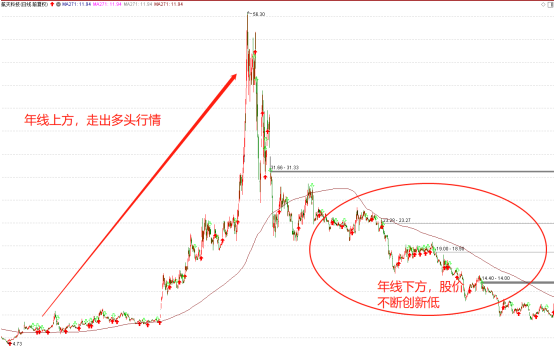

周末重磅!人形机器人“天工”实现拟人奔跑!产业缺口巨大,超跌 高增长潜力股出炉 【独家课堂】年线的运用技巧

【独家课堂】年线的运用技巧 【热点跟踪】市场风格大切换,科技股全面爆发

【热点跟踪】市场风格大切换,科技股全面爆发

评论前必须登录!

登陆 注册